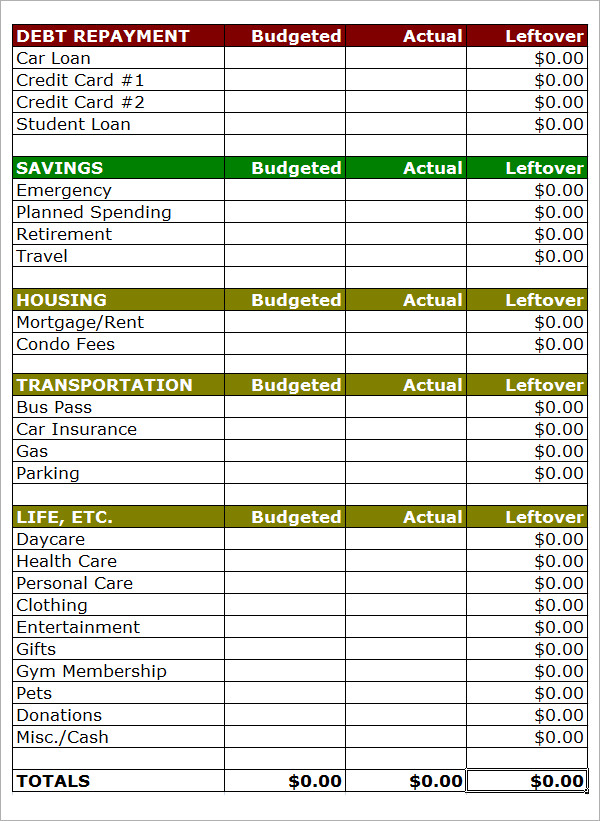

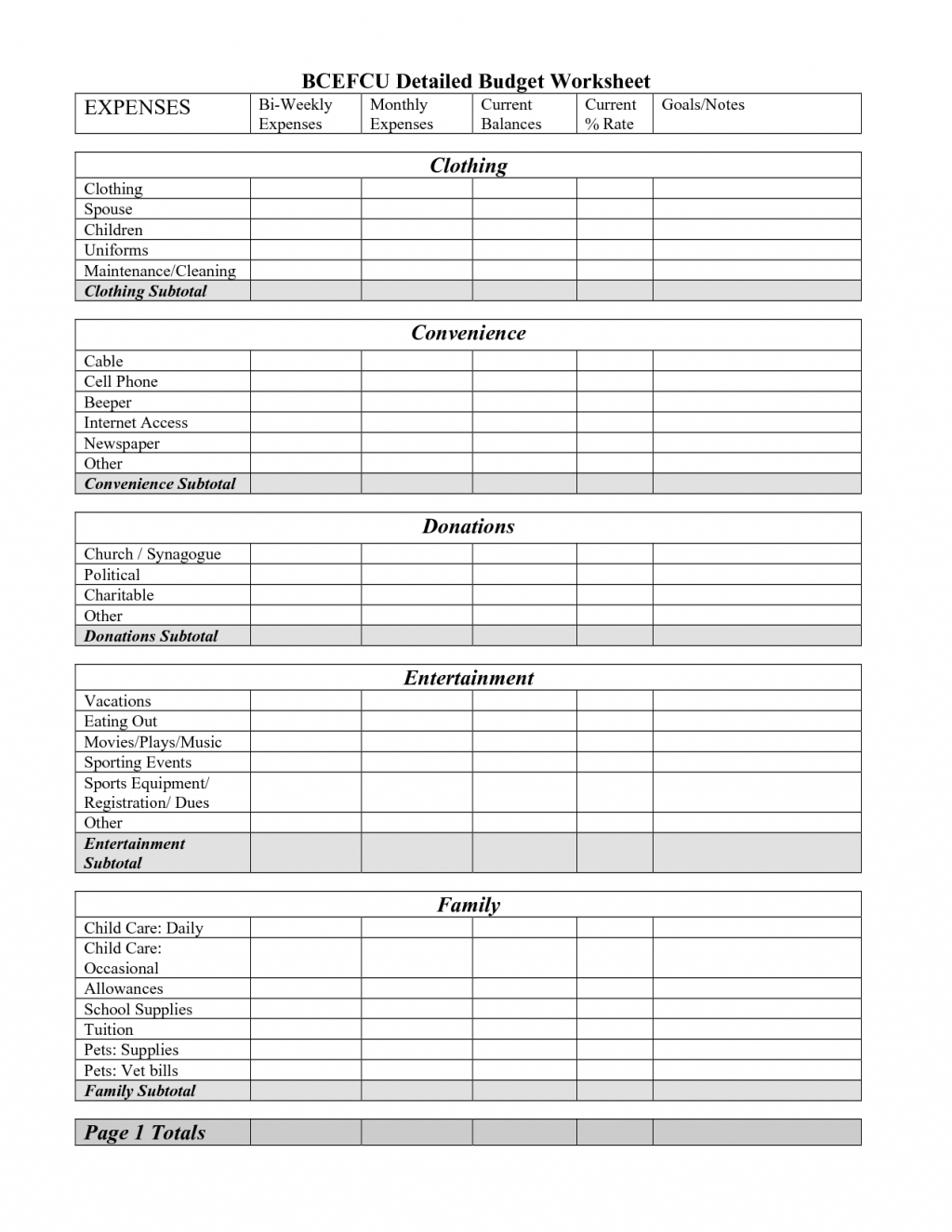

Step 4: Turn it around!įacing the numbers and looking for ways to cut spending, increase income, or changing spending habits can be a messy uncomfortable process. Wherever you spend, however much you owe, whatever you save - Your monthly totals are not your self worth, it’s your starting line. Family: Childcare, allowance, activities, books, toys.Routine Expenses: Groceries, clothing, personal.Enjoyment: Gifts, holiday, pets, entertainment, restaurants, hobbies.Financial: Bank fees, interest payments, debt repayment, savings accounts.Medical: Prescriptions, dental, health insurance.Utilities: Streaming, internet, phone, electricity, water.Transportation: Car, transit, fuel, maintenance, bicycle.Home Expenses: Rent, mortgage, insurance, maintenance, property taxes.Income: Salary, bonuses, investments, spousal income.Fill in the blanks and account for your cash. Grab your receipts, sort your bills, and check your bank accounts. But getting past the feels can lead to greater money confidence and increased financial independence.

Feeling overwhelmed and stressed is normal.

Documenting your income and expenses is one of the most important steps toward managing your money.

0 kommentar(er)

0 kommentar(er)